Empower your insurance organization with Everbridge

Safeguard your employees, protect client data, and maintain seamless operations with Everbridge. Our solutions are tailored to enhance resilience and enable insurance organizations to remain focused on their customers, no matter the situation.

Keep your people safe and your organization running

Everbridge provides insurance organizations with cutting-edge emergency communication tools and tailored risk intelligence. Act swiftly during critical events to protect employees, secure sensitive client information, and minimize service disruptions. With Everbridge, you can ensure business continuity, uphold client trust, and enhance resilience against any threat.

Know earlier, respond faster, and improve continuously in how you deal with threats

Stay ahead of physical and digital threats like weather events, active assailants, or IT disruptions. The Everbridge Critical Event Management (CEM) platform empowers resilience by enabling you to:

1. Know earlier

With advanced business continuity planning and leading risk intelligence, you’ll get real-time insights to detect threats wherever they arise, helping you quickly identify risks to your people and operations.

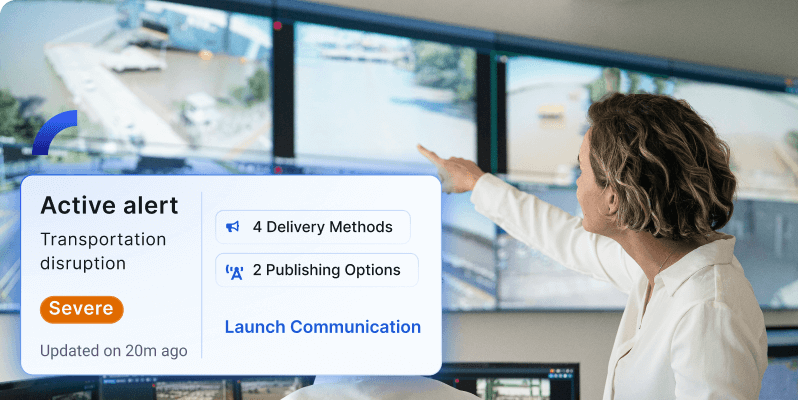

2. Respond faster

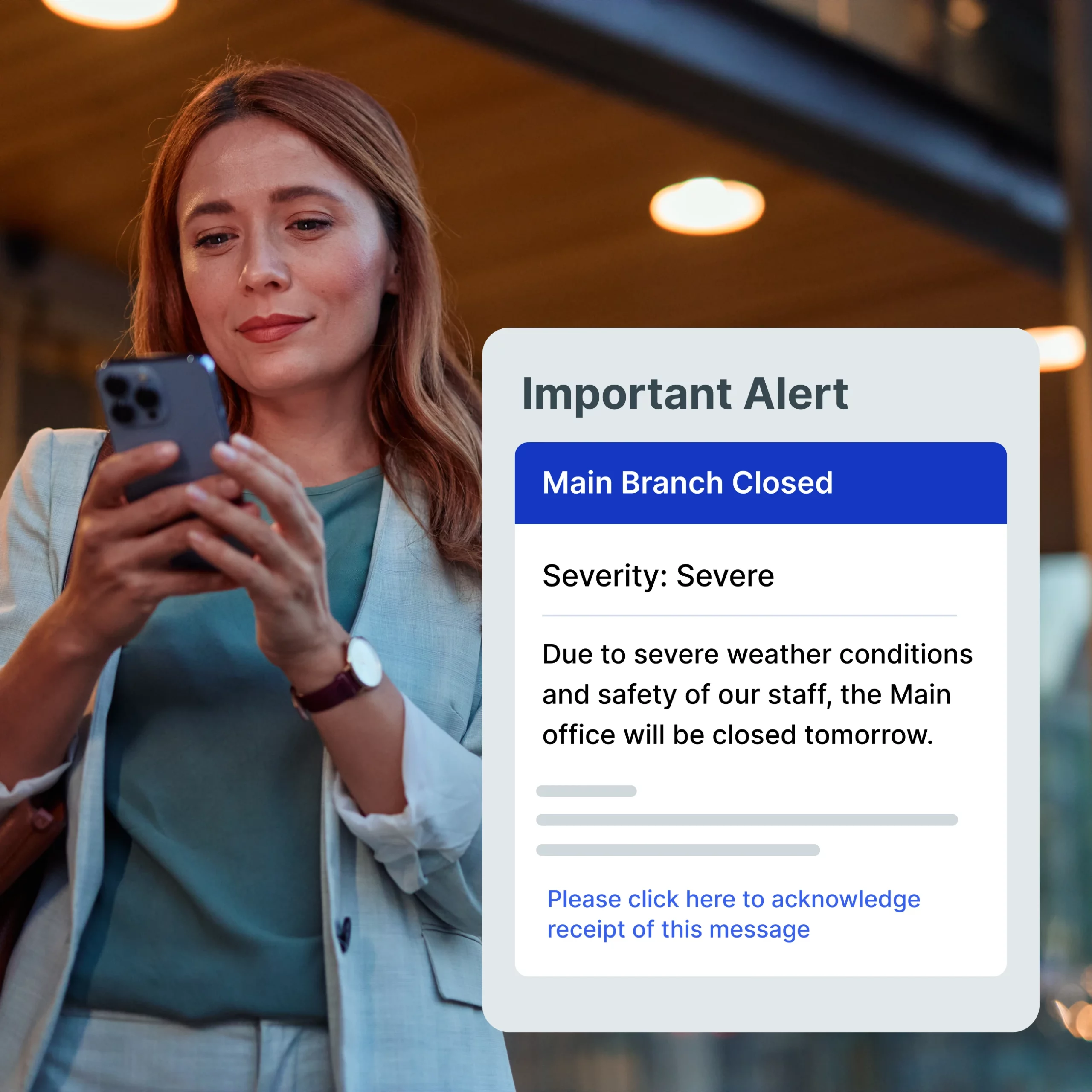

When critical events happen, speed matters. Our Alert Management feature enables seamless, “one-click” responses, from emergency communications to clear instructions, keeping your employees safe and your business protected.

3. Improve continuously

Adapt and improve with our detailed after-action reports, response analytics, and interactive dashboards. Turn data into insights to strengthen your organization’s resilience for the future.

How Everbridge empowers the insurance sector

Proactive risk management

Access real-time risk insights to identify and address potential threats, ensuring the protection of employees and client data.

Efficient claims processing

Streamline response workflows with automated actions that improve efficiency and reduce effort.

Clear communication channels

Foster two-way communication to swiftly manage emergencies, safeguard employees, and provide timely updates.

Enhanced operational resilience

Utilize real-time risk intelligence and automated tools to fortify operations, comply with industry regulations, and deliver reliable services.

How it works

Everbridge integrates real-time risk intelligence, automated workflows, and seamless communication tools into a robust platform designed for the insurance sector. It enables organizations to identify potential threats early, safeguard client data, and respond swiftly to minimize disruptions. Whether addressing natural disasters, cyber threats, or operational crises, the platform ensures efficient claims processing, clear communication, and continuity of service. With Everbridge, insurance organizations can consistently uphold client trust, meet stringent regulatory requirements, and strengthen operational resilience.

MLC Life Insurance strengthens crisis communications capabilities with Everbridge

MLC Life Insurance is one of Australia’s largest insurance companies, serving customers for more than 135 years. MLC Life Insurance offers a wide range of life insurance options to their 1.2 million customers. MLC Life Insurance relies on Everbridge Safety Connection and Crisis Management to keep their employees safe and informed during crises.

How your insurance organization can benefit from using Everbridge

Critical event management

Ensure the safety of your employees and the security of client data while maintaining uninterrupted operations during emergencies. Everbridge empowers insurance organizations with accelerated response times, and enhanced operational continuity.

Business continuity

Prepare for any critical event with tools designed to simplify contingency planning and enable quick, effective responses. Minimize downtime, avoid service disruptions, and ensure uninterrupted support for policyholders, no matter the challenge.

Travel risk management

Safeguard traveling and remote employees with real-time alerts and actionable guidance tailored to their needs. Mitigate risks, protect your team, and enable them to work confidently and securely from any location.

Digital operations

Maintain the reliability of essential systems that power your business. Proactively identify and resolve operational challenges to avoid service delays, optimize performance, and deliver seamless, dependable workflows to clients.

See Everbridge 360™ in action

Embark on a virtual tour of the Everbridge 360 platform, guided by AI Michael. Discover how Everbridge serves as a vital partner in fostering a resilient future for organizations.

Outcome

Insurance organizations leveraging Everbridge gain stronger operational resilience, faster response times, and uninterrupted service delivery. Potential vulnerabilities are mitigated, safeguarding client data and ensuring alignment across teams during critical moments. The safety of employees and clients is prioritized, fostering trust and long-term relationships. Additionally, Everbridge streamlines regulatory compliance, helping your organization not only meet but surpass industry requirements. By ensuring seamless operations and reliable service, Everbridge positions your company to excel in a competitive and dynamic insurance market.

Everbridge named a Leader in The Forrester Wave™: Critical Event Management

Empower resilience with the leading critical event management platform.

Featured resources

Global Threat Outlook 2025

Download our newly released report “Global Threat Outlook 2025.” The report provides essential insights and strategies for navigating the intricate landscape of global threats.

2025 Global Enterprise Resilience Report

Download the report for analysis on industry surveys, insights into the threats resilience leaders are watching, and ways to adopt a more flexible and effective approach to readiness.

Building a thriving workplace: How culture drives resilience

Workplace culture isn’t just about perks or policies—it’s what determines how teams handle change, pressure, and challenges.

Embracing regulatory resilience

Regulatory demands are growing, and businesses need to be ready. In this interview, Dave Wagner talks about how staying ahead of regulations like DORA isn’t just about compliance—it’s about protecting your business.

Enhancing executive protection with Everbridge Signal: Monitoring social media for threat intelligence

Enhance executive protection with Everbridge Signal’s AI-driven social media monitoring.

Achieve operational resilience in a regulated world

Building true operational resilience has never been more critical, especially in the face of regulations like DORA and the Bank of England’s operational resilience framework.