Operationalize DORA compliance

Everbridge provides customers with a complete solution that digitizes organizational resilience. As a leader in the field, Everbridge offers a suite of powerful tools to help financial organizations know earlier, respond faster, and improve continuously.

What is DORA?

DORA is an EU-wide regulation that establishes a uniform framework to enhance the operational resilience of digital systems within financial institutions. DORA will drive significant change in the financial sector, requiring organizations to ensure the resilience, continuity, and availability of their information and communication technology (ICT) systems, while adhering to stringent data security standards.

Compliance with DORA requires increased documentation to demonstrate adherence. Organizations must document their ICT and information assets, develop comprehensive encryption and cryptographic control policies, and establish protocols for network security management and data transfer protection.

DORA guidelines for the financial sector

The frequency of cyber-attacks is growing exponentially and to combat this, in 2025, the EU introduced the Digital Operational Resilience Act (DORA), establishing stringent guidelines for the financial sector. These encompass cybersecurity, risk management, and continuity planning, aiming to create a more robust and secure financial infrastructure.

For compliance officers and IT professionals, compliance with DORA is essential. Technology solutions like Everbridge CEM can streamline processes, automate tasks, and optimize resources, ensuring your organization can seamlessly align with the new regulations.

Why Everbridge?

Everbridge stands at the forefront of resilience, empowering organizations with comprehensive solutions that operationalize regulatory compliance and empower resilience.

Our platform supports essential DORA articles by focusing on critical areas:

- Identification of key information assets and ICT-supported business functions;

- Protection and prevention through safeguarding measures for ICT systems;

- Detection via early threat identification and scenario testing; and

- Response and recovery by establishing business continuity plans for maintaining critical functions during ICT incidents.

With advanced incident management, proactive risk monitoring, and seamless communication capabilities, Everbridge can automate responses, bolster collaboration, and enhance situational awareness. Helping financial institutions improve incident response times, reduce disruptions, and boost organizational resilience.

DORA chapters

ICT risk management

Everbridge supports regulatory compliance and operational resilience with robust incident management, risk monitoring, and business continuity tools. Tailor and update plans for ICT incidents, maintain transparency with detailed reports, and estimate financial impacts using impact trackers. Stay ahead of disruptions with early insights into operational threats.

Digital operational resilience testing

Everbridge enables financial entities to conduct scenario testing and automate communications during events, accelerating mitigation and resolution. Track mitigating controls, reduce risk scores, and establish severity levels. Regular testing and post-event analysis enhance incident response, improving mean-time-to-acknowledge and resolve incidents, and minimizing disruptions effectively and efficiently.

Managing third-party risk

Everbridge offers unparalleled ICT-third party monitoring, linking data dependencies across services and locations for clear visibility. Ensure continuous monitoring of critical functions and maintain operational resilience. Automated audit trails reinforce control, while instant notifications and detailed reports address compliance issues swiftly, ensuring effective action.

Information sharing

Effortlessly share critical data with executives and external parties using shareable dashboards, impact trackers, and reports. Create secure networks for regulatory information sharing. Financial institutions can disseminate vulnerability and threat information, boosting situational awareness and collaboration. This proactive approach ensures better preparedness for ICT-related incidents, enhancing organizational resilience and security.

WHO WILL BE IMPACTED?

Although DORA is EU legislation, it will impact any financial and digital organization which provides services, either directly or indirectly to European organizations. This includes banks, credit unions, insurance companies, and ICT third-party providers such as cloud service providers, payment processors, and fintech firms.

Industry solutions for DORA

DORA solutions for banking

Everbridge can help banks fortify their digital infrastructure against disruptions. Our solutions will help ensure compliance, protect customer data, maintain operational continuity, and strengthen digital resilience against crises and threats.

DORA solutions for payments

Everbridge can help enhance security by continuously monitoring transactions, identifying potential risks, and providing real-time alerts. With Everbridge, payment systems can maintain operational resilience, protect sensitive data, and deliver seamless financial services to customers worldwide.

DORA solutions for insurance

Everbridge can empower insurance companies to meet regulatory requirements and enhance operational resilience. With advanced risk management tools, real-time monitoring, and automated incident response, insurers can protect critical operations, ensure compliance, and maintain customer trust in an evolving digital landscape.

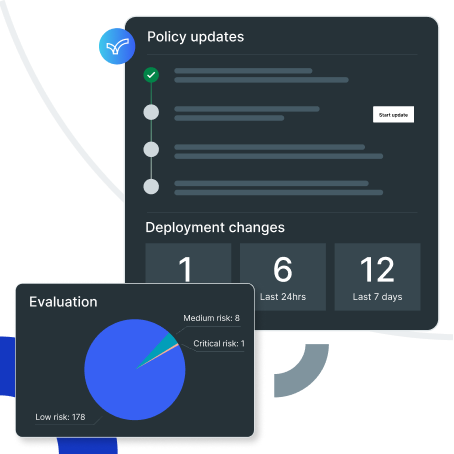

Additional documentation needs

Time-consuming and resource-intensive reporting requirements.

Technology integration

Complex ICT risk management and advanced software deployment challenges.

Governance maintenance

Continuous monitoring, regular audits, and policy updates needed.

Change management

Balancing innovation and continuity amid rapid technological advancements.

How to comply for DORA using Everbridge:

Benefits

- Enhanced resilience: strengthen digital resilience against crises and threats.

- Regulatory compliance: ensure compliance with DORA and other EU mandates.

- Streamlined processes: automate ICT risk management and reporting workflows.

- Proactive risk management: identify and mitigate risks before they escalate.

Features

- Advanced AI integration: leverage AI for efficient risk assessments and responses.

- Automated alerts: receive real-time alerts for immediate action on incidents.

- Comprehensive reporting: generate detailed reports to demonstrate compliance efforts.

- Centralized security management: manage physical and digital security from a single platform.

Santander saves time and cost with critical event management

Within a single platform, Santander can now coordinate response activities, teams, and resources to accelerate recovery times and maintain command and control during a crisis.

Solutions for DORA compliance

Digital resilience is crucial for navigating crises and safeguarding financial and security assets and DORA has strengthened the digital ecosystem. Everbridge provides a comprehensive solution to help organizations prepare for and comply with DORA, ensuring the resilience, continuity, and availability of their information and communication technology (ICT) systems while upholding stringent data security standards.

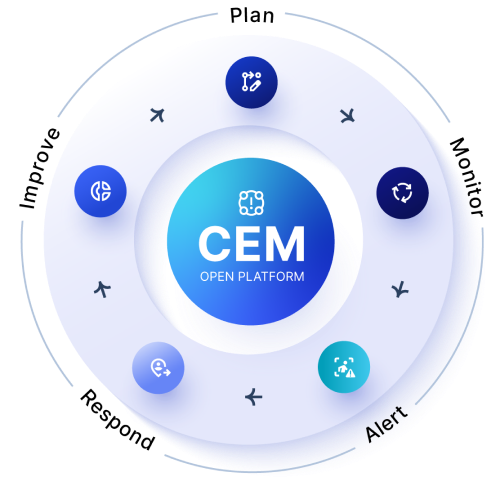

How it works

Everbridge leverages AI and software solutions to streamline compliance with DORA. Our platform offers critical event management (CEM) capabilities, automating processes, enhancing visibility, and provides robust support for physical security, ICT security, and change management. By integrating risk assessment, auto-remediation, incident management, and reporting capabilities, Everbridge enables organizations to identify vulnerabilities, monitor performance, and implement security controls seamlessly.

Outcome

With Everbridge, organizations can simplify their compliance efforts and build operational resilience. Our solutions empower businesses to respond proactively to crises, communicate efficiently with stakeholders, and maintain continuity in operations. By leveraging Everbridge, financial institutions can meet EU mandates on digital resilience, drive innovation, and gain a competitive edge, ensuring they are well-prepared to prevent crises and effectively navigate the complexities of DORA regulations.

Understand the impact of the requirements

Supporting resources

Unlocking DORA, from policy to operationalization

Delve into the challenges and strategies faced by financial institutions in implementing strategies and tactics to comply with Operational Resilience Act (DORA).

Ensuring business continuity: How to use regulatory frameworks to your advantage

Explore how regulatory frameworks boost organizational resilience across multiple sectors. Gain insights into DORA, BoE guidelines, and FFIEC standards.

Everbridge for EU regulations: NIS2, DORA, Cyber Resilience Act

Leverage Everbridge solutions to operationalize EU regulations including NIS2, DORA, and the Cyber Resilience Act. Enhance your compliance and strengthen your cyber defenses.

Understanding DORA: How to operationalize digital resilience

The DORA regulation affects financial services organizations. Complying with DORA presents many challenges. Learn how Everbridge can support DORA compliance.

International Security Journal interview with Tracy Reinhold, Chief Security Officer

What are Everbridge’s perspectives on the Cyber Resilience Act (CRA), Digital Operational Resilience Act (DORA) and NIS2 Directive (NIS2)?

DORA FAQ for financial institutions

Everbridge provides customers with a complete solution that digitizes organizational resilience. As a leader in the field, Everbridge offers a suite of powerful tools to help financial organizations know earlier, respond faster, and improve continuously.

DORA FAQs

The Digital Operational Resilience Act (DORA) is a regulation proposed by the European Union to ensure that financial entities within the EU can withstand, respond to, and recover from all types of information and communication technology (ICT) incidents. It aims to harmonize the digital resilience requirements across the financial sector, addressing the risks posed by increasing reliance on digital technology in financial services.

Compliance with DORA is mandatory for a wide range of financial entities, including banks, insurance companies, investment firms, payment institutions, and credit rating agencies. Additionally, ICT service providers that have contracts with these financial entities may also be within the scope of DORA compliance.

The five pillars of DORA encompass:

ICT risk management: Establishing a robust framework to manage all ICT risks.

Incident reporting: Implementing processes for the comprehensive reporting of significant ICT-related incidents.

Digital operational resilience testing: Periodic testing to ensure systems can withstand cyber threats.

ICT third-party risk: Managing risks associated with third-party ICT service providers.

Information sharing: Facilitating the exchange of relevant cyber threat information and intelligence.

Organizations must implement a comprehensive ICT risk management framework, conduct regular resilience testing, have a solid incident reporting mechanism, manage third-party risks effectively, and participate in information sharing. They should also ensure the continuity of critical functions and services during disruptions.

While the exact penalties can vary, non-compliance with DORA can lead to substantial fines and other regulatory sanctions. Financial entities may face monetary penalties, reputational damage, and increased scrutiny from regulatory bodies.

A digital resilience strategy is a comprehensive plan that financial entities develop to withstand and quickly recover from ICT incidents. This strategy includes risk assessments, incident response plans, testing protocols, and measures for continuous improvement. It aims to ensure uninterrupted operation of critical functions even during cyber incidents.

Proposal Date: The European Commission proposed DORA on September 24, 2020.

Implementation: DORA entered into force on 16 January 2023 and will apply as of 17 January 2025.

Compliance Deadline: Organizations should aim to have necessary changes implemented by the enforcement date to ensure full compliance. Regular updates and guidelines will be published by regulatory authorities to assist entities in their compliance efforts.